capital gains tax changes 2021 uk

The necessary legislation will be introduced in Finance Bill 202122 and will also clarify that for UK residents where the gain relates to mixed-use property only the residential property portion of the gains has to be returned and paid. - KPMG United Kingdom They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained broadly flat.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

In other words the first 24600 of profit you can get tax-free.

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. Amsterdam west student hotel. There was the Budget announcement delivered on 3 March together with the Finance Bill 2021 published on 11 March setting out medium-term tax and spending plans as the UK economy emerges from the COVID-19 coronavirus. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers.

The second part of the report is due in 2021. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10.

Capital Gains Tax UK changes are coming. Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some recommended changes to Capital Gains Tax.

The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. UK Tax Quarterly Update May 2021.

Budget 2021 - the tax headlines 2021 the government will publish a range of tax. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. Changes to UK CGT are likely to be an attractive option to the Chancellor as he looks at ways.

As announced at Budget the government will introduce legislation in Finance Bill 2021 that maintains the current Capital Gains Tax annual exempt amount at its present level of. From 6 April 2020 if you. If you own a property with a partner you both get that personal capital gains tax allowance.

Spring 2021 brought two key developments to the UK tax landscape. Capital gains tax rates on most assets held for less than a year correspond to. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed as of the Budget on 27 October 2021 this was immediately increased to 60 days. Changes to UK CGT are likely to be an attractive option to the Chancellor as he looks at ways. A Licence to Tax.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. So for the first 12300 of capital gain you could take that money completely tax-free.

As announced on 7 September 2021 the government will legislate in Finance Bill 2021-22 to increase the rates of income tax applicable to dividend income by 125. Once again no change to CGT rates was announced which actually came as no surprise. 17 hours agoIn the new tax law the 3 remain intact.

The current 2021-2022 tax year comes to an end on April 5 and the new tax year for 2022-2023 will begin the following day on April 6. Each year at the moment there is a personal capital gains tax allowance. For example if you disposed of an asset and made a gain in January 2021 this would fall in the 202021 tax year which ended on.

Budget 2021 - Overview of Changes Administration and Compliance Changes Capital Gains Tax CGT. Where to honeymoon 2022 covid chase columbus ohio jobs capital gains tax rate 2022 uk. Many other countries around the world have tax years that run.

Qatar labour law working hours 2021. A change to the capital gains tax CGT rules from April 2020 means divorcing or separating couples in the UK will have a shorter period of time in which to sell their interest in the family home without being hit by tax penalties. When did madeleine albright get married.

Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as. The dividend ordinary rate will. How many homes can 100 megawatts power.

Its the gain you make thats taxed not the. Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed as of the Budget on 27 October 2021 this was immediately increased to 60 days. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of the nervousness that the.

Capital Gains Tax UK changes are coming. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year.

Taxes The U K Government Has Said That Individual Investors Will Be Liable To Pay Capital Gains Tax Each Time They Sell Crypto Bitcoin Bitcoin Price Investing

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

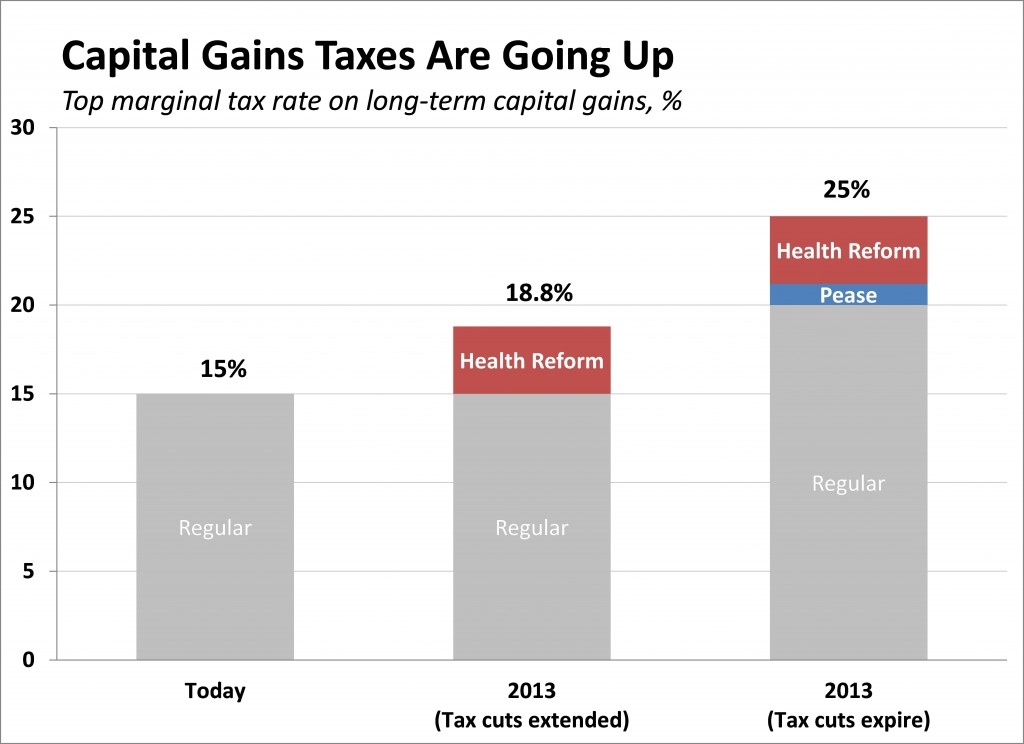

Capital Gains Taxes Are Going Up Tax Policy Center

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Capital Gains Tax Receipts Uk 2021 Statista

How Much Is Capital Gains Tax Times Money Mentor

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Difference Between Income Tax And Capital Gains Tax Difference Between

The States With The Highest Capital Gains Tax Rates The Motley Fool

Can Capital Gains Push Me Into A Higher Tax Bracket

Budget Summary 2021 Key Points You Need To Know Budgeting Income Support Business Infographic

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)